Family membership

Health insurance provides insurance benefits not just to insured persons but also to their dependent family members. These family members are referred to as “dependents”. Family members must meet certain conditions related to “residency in Japan,” “the extent of the family relationship,” and “income” before they are authorized as dependents.

- * You must apply to Rakuten KENPO in addition to registration of dependents in your employer's (company's) HR system.

Review the following procedures and submit the required documents to your employer's (company's) HR section.

- Tips

-

- Dependents must be certified by the Health Insurance Society.

- If there is any change in your dependents, submit notification of the change within five days.

Extent of family relationship

Only family members within the third degree of consanguinity may be certified as dependents. Conditions for dependent eligibility also vary depending on whether or not the family member lives with the insured person.

Income standards

To be certified as a dependent, a family member must live primarily off the income of the insured person.

| If the family member lives with the insured person | If the family member lives apart from the insured person |

|---|---|

| The family member's annual income must be less than 1.3 million yen (1.8 million yen if aged 60 or above, or disabled) and it must be less than one-half the income of the insured person. | The family member's annual income must be less than 1.3 million yen (1.8 million yen if aged 60 or above, or disabled) and must be less than the amount of the allowance sent to the family member from the insured person. |

Income for self-employed persons

Income for salary earners is based on gross income. For the self-employed, the portion qualifying as income can vary at the various stages of revenue accounting. Thus, the Rakuten KENPO applies the following standards for self-employed persons:

- Income is defined as revenue before deductions for necessary expenses, not final taxable income amount. (The rationale behind this approach is that the income of salary earners is also regarded as the amount before deductions for necessary expenses?in their case, salary deductions.)

- However, purchasing costs are deducted for self-employed persons involved in businesses involving merchandise sales or food service, since the direct cost of purchasing stock cannot be considered revenue. Income in this case is defined as net sales minus purchasing costs?or what is generally referred to as gross profit on sales.

Government measures to address annual income barriers (starting in October 2023)

What are annual income barriers?

Annual income barriers refer to threshold income amounts that determine whether or not taxes and social insurance premiums are incurred.

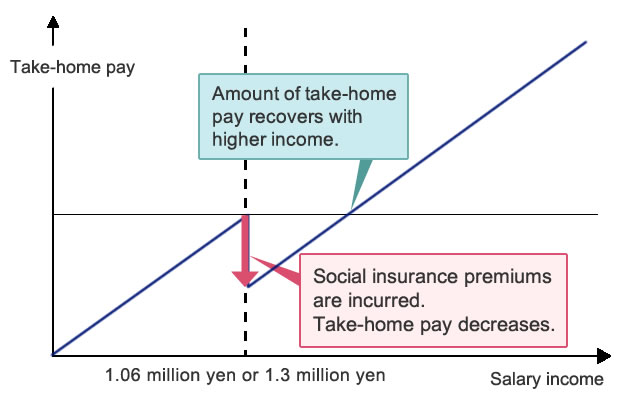

Individuals who have dependent status and work part-time or other non-regular jobs will lose their dependent status if their annual income exceeds a certain figure, and become an insured person under a company health insurance plan, National Health Insurance, or other insurance system. They will then be required to pay social insurance premiums, which may result in lower take-home pay.

One of two different annual income barriers applies for social insurance premiums, depending on company size and other factors: 1.06 million yen or 1.3 million yen.

(Source: Provisional measures to address annual income barriers (Ministry of Health, Labour and Welfare))

| 1.06 million yen annual income barrier | At companies with 101 or more employees, an employee will incur social insurance premiums if certain conditions, such as when monthly wages are 88,000 yen or more (i.e., annual income is approximately 1.06 million yen or more), are satisfied. |

|---|---|

| 1.3 million yen* annual income barrier | Social insurance premiums are incurred automatically without exception, since the worker no longer meets the dependent eligibility criteria. |

- * 1.8 million yen if aged 60 or above or disabled

Handling for the 1.3 million yen annual income barrier

Although dependent certification is based on checking of taxation certificates and other documents from the previous year, if the worker’s annual income is expected to temporarily exceed 1.3 million yen due to longer hours because of labor shortage or other factors, the worker may choose to retain his or her dependent status simply by attaching a certificate from the employer.

(In principle, this handling is available no more than two consecutive times for a single worker.)

Handling for the 1.06 million yen annual income barrier

Companies that help increase worker income through means such as payment of allowances to encourage social insurance coverage* will be provided subsidies for a finite term.

* Allowances to encourage social insurance coverage

These allowances are intended to encourage employee insurance coverage for those working reduced hours and to reduce the burden of insurance premiums when workers who had been ineligible for insurance are newly covered by insurance.

Allowances to encourage social insurance coverage are to be paid apart from salaries and bonuses. They are not considered when calculating the standard monthly remuneration or standard bonuses used to determine insurance premiums.

- * Eligible persons: Those with standard monthly remuneration of 104,000 yen or less

- * Maximum allowance amount excluded from standard remuneration: Amount equivalent to the insurance premiums newly incurred by the employee due to insurance coverage

- * A time-limited measure not to exceed two years

Domestic residency requirement

A family member must be a resident of Japan (i.e., must hold a certificate of residence in Japan) to be named a dependent (“domestic residency requirement” hereinafter).

However, even a family member holding a certificate of residence in Japan will be deemed not to meet the domestic residency requirement if he or she actually does not reside in Japan—for example, in the case of a family member who works overseas and is not living in Japan at all. A family member who lacks an address in Japan may be deemed to satisfy the domestic residency requirement on an exceptional basis if he or she is recognized to have a livelihood based in Japan. See the “Procedures” page for more information.

Requirements when applying to have a parent, mother-in-law, father-in-law, or grandparent recognized as a dependent

As a matter of course, married couples are assumed to live together and to have primary responsibility for mutual aid and support, so they strongly rely on the income of each other for their livelihood.

For this reason, if a parent or grandparent for whom you are applying for dependent certification has a spouse, the actual conditions of the couple’s household and livelihood will be assessed to determine whether or not the subject of the application depends mainly on the income of the insured person for his or her livelihood on a continual basis.

Specifically, even if one of the spouse’s incomes is below the standard amount, if the other spouse earns enough for both spouses to live on, that spouse is regarded as the person with primary responsibility for the couple’s livelihood, and the parent or grandparent may not be named a dependent of the insured person.

If a dependent family member is not Japanese

In principle, a family member must live in Japan to be considered a dependent. Applicants lacking a family visa or resident card will be regarded as ineligible for dependent certification. (Family members staying in Japan for short periods are not considered to live in Japan because such arrangements are temporary and their primary residence remains unchanged.)

Date of certification

In principle, the notification must be submitted within five days after the reason for adding the family member arises. However, notifications submitted more than five days later will be handled as follows:

- Notifications received (by the Association) within two months after the date the reason for adding the family member arose:

certified retroactive to the date on which the reason for adding the family member arose - Notifications received (by the Association) more than two months after the date the reason for adding the family member arose:

certified effective from the date on which the notification was received

- ** Note that certification in both cases 1 and 2 above requires verification of all documents attached and other materials.

If there has been a change in dependents

You must take specific steps if the number of dependents increases due to marriage or childbirth or a family member is no longer eligible as a dependent for reasons such as employment, living apart from the insured person, or death.

Eligibility will be cancelled retroactively if you fsubmit a factually inaccurate notification or do not submit the notification required. If so, you will be required to repay all medical care expenses and benefits provided during that time.

The Health Insurance Society checks the eligibility status of dependents annually.